Old and New Tax Regime: Which is better?

The Union Budget 2020 introduced a new personal tax regime in addition to the existing Old Tax Regime for individual taxpayers. However, the New Tax Regime is optional. To put it simply, the assessee can choose between the New Tax Regime and the Old Tax Regime depending on what is best suitable from a tax planning point of view.

The Income Tax Department has provided help for making a comparison between old and new tax regime and is available on the website: https://www.incometaxindiaefiling.gov.in/Tax_Calculator/index.html?lang=eng

where you can input the total income (before exemptions and deductions) and the total exemptions and deductions separately and the website will show the comparison (and benefit) under the two regimes.

The employees need to furnish their declaration of opting for the Old or the New scheme to their employers at the start of the year, purely for the purpose of calculating the TDS on their salaries. However, the New option for such a concessional tax regime requires the taxpayer to forego certain specified deductions. These include the standard deduction of Rs 50,000, deduction under section 80C of Rs 1.5 lakh and interest on the self-occupied property of Rs 2 lakh which are availed by most taxpayers. As a result, the concessional tax regime may not always be beneficial.

There is an only sure-shot way to decide on this; prepare a statement of computation of total income for the year 2020-21 and calculate your tax liability on the same, both under the Old and New regime. At the end of this statement, whichever column shows you lower taxes, go for it.

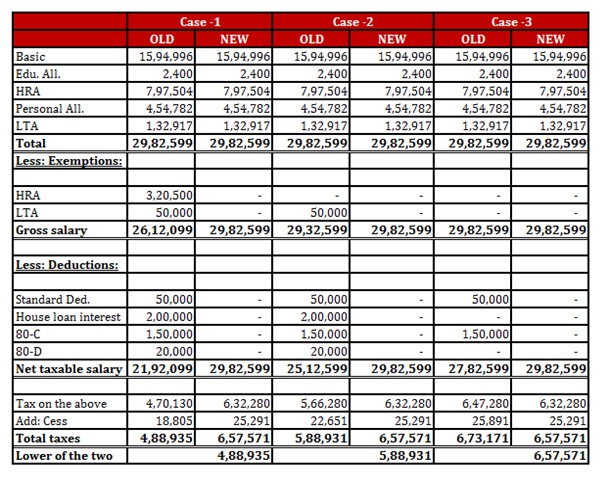

To understand this situation practically, let’s look at how the calculation and comparison work out for three different cases on the same salary chart.

Case 1 looks at the tax computation and comparison for the individual, who is claiming exemption benefits under HRA, LTA and deductions for a home loan, section 80C and 80D and standard deduction.

Case 2 looks at the tax computation and comparison for the same individual, who is claiming exemption benefits under LTA and deductions for a home loan, section 80C and 80D and standard deduction.

Case 3 looks at the tax computation and comparison for the same individual, who is claiming deductions under section 80C and standard deduction.

The table below can be used as a reference point to understand how the comparison works for each of the above 3 cases:

So many other combinations are possible here i.e. NPS, Interest on education loans, rental income, interest income earned on investments, etc. Once the individual’s salary computation and resulting tax position been worked out, the results will help decide which regime to choose.

An interesting point to note here is that this declaration to the employer is not the ultimate decision point, he/she (as a tax filer) can still decide and take the final decision before the filing of return. In other words, the individual may have opted for the new regime at the start of this financial year, but he can still opt for the old regime before he/she files his return of income.

Courtesy: NetworkFP

three comments

Very good article.

Very helpful and well articulated!

Nice Article